Downloading Invoices from Google Ads

This guide explains how to download invoices from Google Ads using the updated interface.

Steps to download your invoice from Google Ads

1. Log in to your Google Ads account.

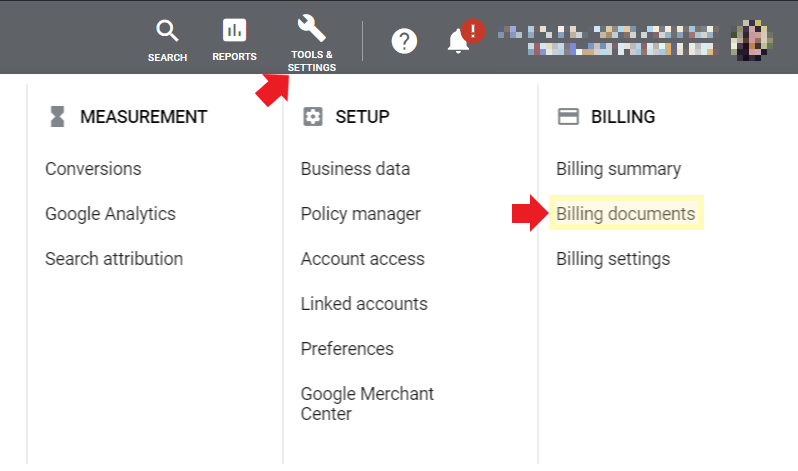

2. Click the tools icon and select Billing documents

-

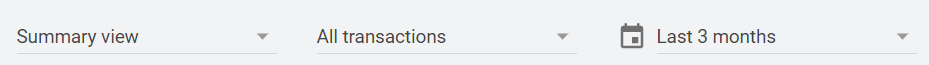

- It should take you to the Transactions tab under the Billing page. You can select different options from the drop-down menus to create a billing document.

- You’ll see drop-down menus where you can filter the invoices or transaction types you want to download.

- It should take you to the Transactions tab under the Billing page. You can select different options from the drop-down menus to create a billing document.

-

-

- View: Choose between a detailed transaction view or a summary view.

- Transaction Type: Filter by the type of transaction (e.g., payments, adjustments).

- Date Range: Select the period for which you want to download invoices (e.g., monthly or custom range).

- The first table will show you a list with the Ending Balance, Date, Description, and Amount.

-

-

-

- Download as .CSV (for Excel) or print the table directly.

-

Helpful tips!

- Current month’s invoices: The link for the current month's tax invoices and statements won’t appear until the month is over. Instead, you'll see “Invoice not ready” until then.

- Availability: Local tax invoices for a specific month are typically ready by the 5th business day of the following month. For instance, September invoices will be ready by October 5th. However, you can always print receipts for each payment.

- Invoice generation: Invoices are created based on payments made, not the total click costs. If no payments were made in a particular month, no local tax invoice will be generated, or an empty document may appear. Likewise, if your account had no usage, no statement will be generated.

- Browser settings: Ensure that your browser isn’t blocking pop-ups, which could prevent invoices or statements from downloading properly.

Last Updated: December 2, 2024